What Is a Trust in an Online Will and Trust?

A trust is a legal arrangement that allows someone, known as the trustee, to manage assets for the benefit of others, called beneficiaries. In Texas, the most common type is the Revocable Living Trust. This type of trust can be created, changed, or even canceled during your lifetime.

In an online will and trust, the trust typically includes:

- You as the trustee, managing your assets while you are alive and healthy

- You as the primary beneficiary, receiving all benefits while you live

- A successor trustee, someone you choose to take over if you become incapacitated or pass away

This arrangement gives you control now and peace of mind later.

Benefits of Using a Trust in an Online Will and Trust

- Avoiding Probate: Assets in a trust do not go through probate, so your loved ones avoid delays and court costs.

- Planning for Incapacity: If you can’t manage your affairs, your successor trustee can step in without court involvement.

- Maintaining Privacy: Wills become public during probate. Trusts remain private.

These benefits make trusts a smart part of any online will and trust for Texans who want flexibility and control.

Key Differences Between a Will and a Trust

- When They Take Effect: A will takes effect after death. A trust works immediately and continues after death.

- Going Through Probate: A will goes to probate court. A trust avoids probate altogether.

- Planning for Incapacity: A will doesn’t help while you’re alive. A trust can manage your affairs if you’re incapacitated.

- Keeping Things Private: A will becomes public. A trust remains private.

- Covering All Your Assets: A will controls only assets in your name. A trust must be funded during life or named as beneficiary.

How a Will and Trust Work Together

For many Texans, the best solution is to use both tools. That’s why our online will and trust package includes both:

- Pour-Over Will: Ensures anything not already in your trust is added after death.

- Revocable Living Trust: Manages assets now, during incapacity, and after passing—without probate.

- A Unified Plan: One complete solution that protects your wishes and keeps things simple and affordable.

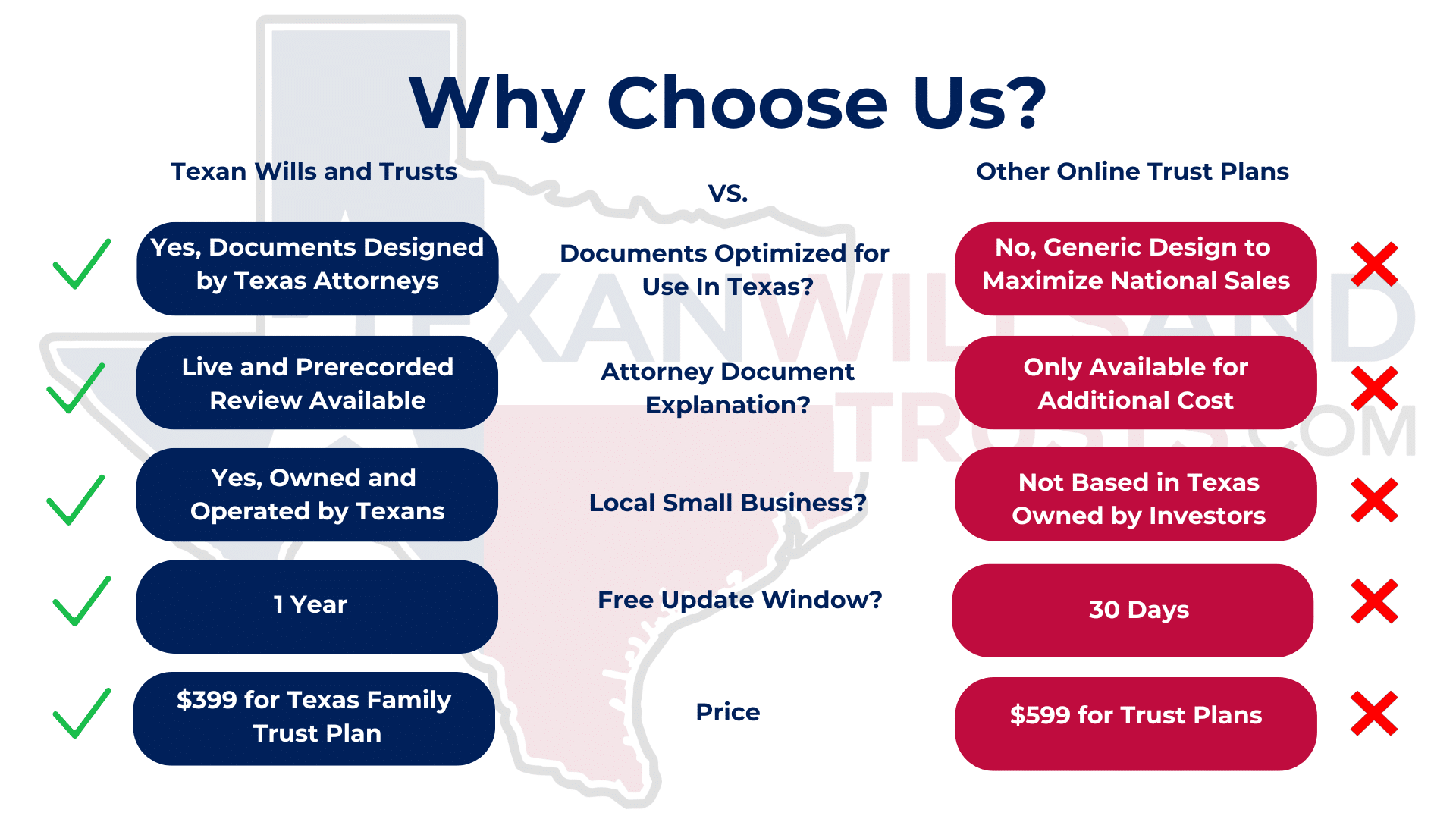

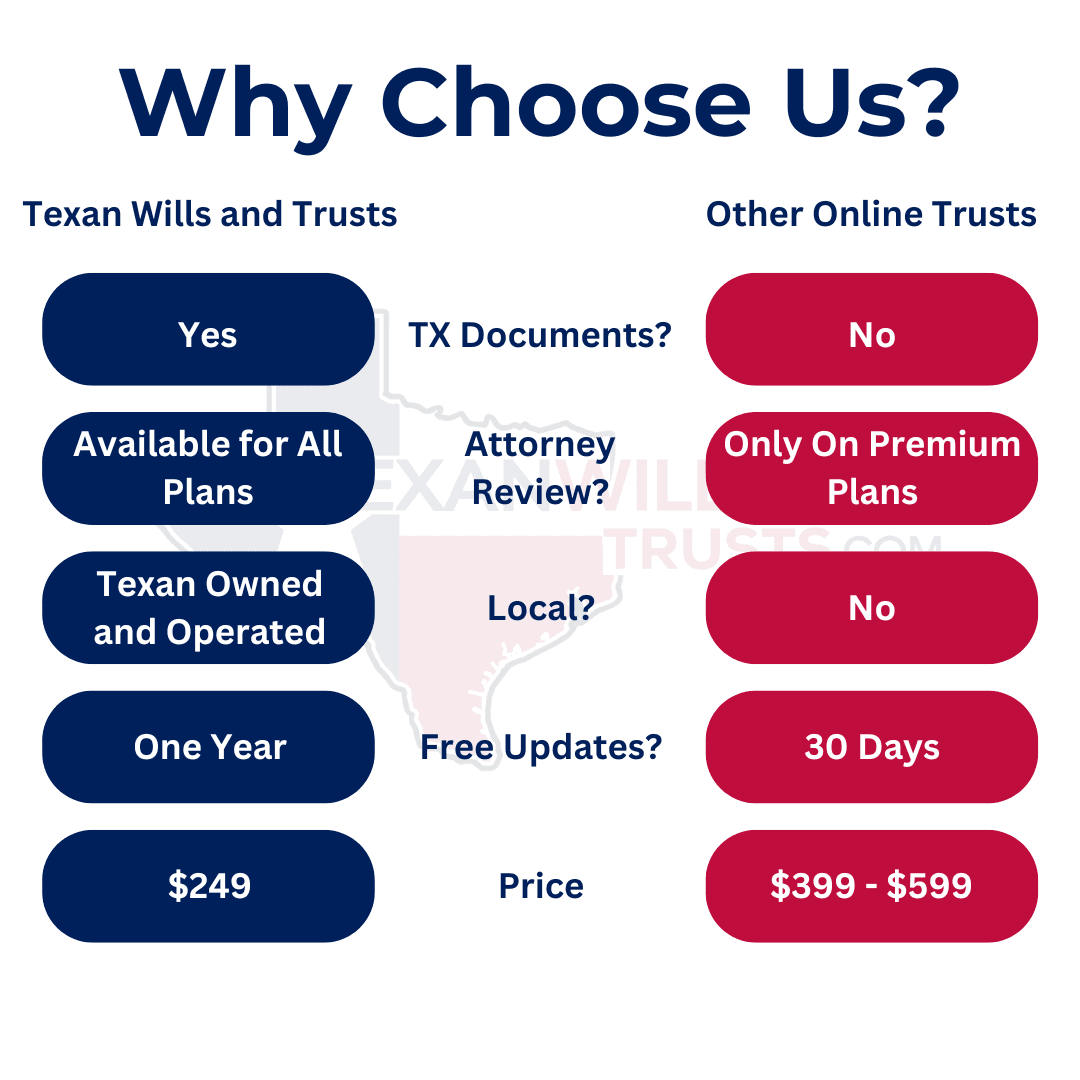

Why Choose the Texas Family Online Will and Trust Plan?

We created this plan to make estate planning fast, affordable, and legally valid for everyday Texans. It includes:

- Last Will and Testament

- Revocable Living Trust

- Financial Power of Attorney

- Medical Power of Attorney

- Directive to Physicians (Living Will)

- Declaration of Guardian

You can even add a one-hour virtual meeting with a licensed Texas attorney to review everything with you—ensuring your plan is accurate and aligned with your goals.

Take the Next Step

Estate planning doesn’t have to be overwhelming. With our online will and trust, you can protect your loved ones and plan ahead—without hiring an expensive attorney or spending weeks on paperwork.

Start your estate plan today at TexanWillsandTrusts.com.

booklawfirm.com