Wills and Trusts

What Happens When You Die Without a Will in Texas

When you die without a will in Texas, your assets are distributed according to the state’s intestate succession laws. This means that instead of your estate being distributed according to your wishes, it will be divided based on a predetermined legal formula. Understanding these laws is crucial for Texans who want to ensure that their loved ones are properly taken care of.

What Does It Mean to “Die Without a Will” in Texas?

When someone dies without a will, they are considered to have died “intestate.” In this situation, Texas law steps in to determine how the decedent’s property is divided among their surviving relatives. The rules of intestate succession are laid out in the Texas Estates Code and vary depending on the decedent’s family structure at the time of death.

Separate vs. Community Property

In Texas, property acquired by a married couple is categorized into two main types: separate property and community property. Separate property refers to assets that one spouse owned before the marriage or acquired individually through inheritance, gifts, or personal injury settlements. On the other hand, community property includes assets acquired by either spouse during the marriage, excluding gifts or inheritances. This distinction is crucial in estate planning because, upon death, community property is typically divided between the surviving spouse and any children, while separate property follows different rules of distribution based on the decedent’s family structure.

Real vs. Personal Property

When discussing property in legal terms, it’s important to distinguish between real property and personal property. Real property refers to land and anything permanently attached to it, such as houses, buildings, and trees. This type of property is immovable and often requires specific legal processes for transfer. Personal property, on the other hand, encompasses movable assets such as vehicles, furniture, jewelry, and bank accounts. Understanding the difference between these types of property is essential in determining how assets are distributed upon death, especially in intestate succession scenarios.

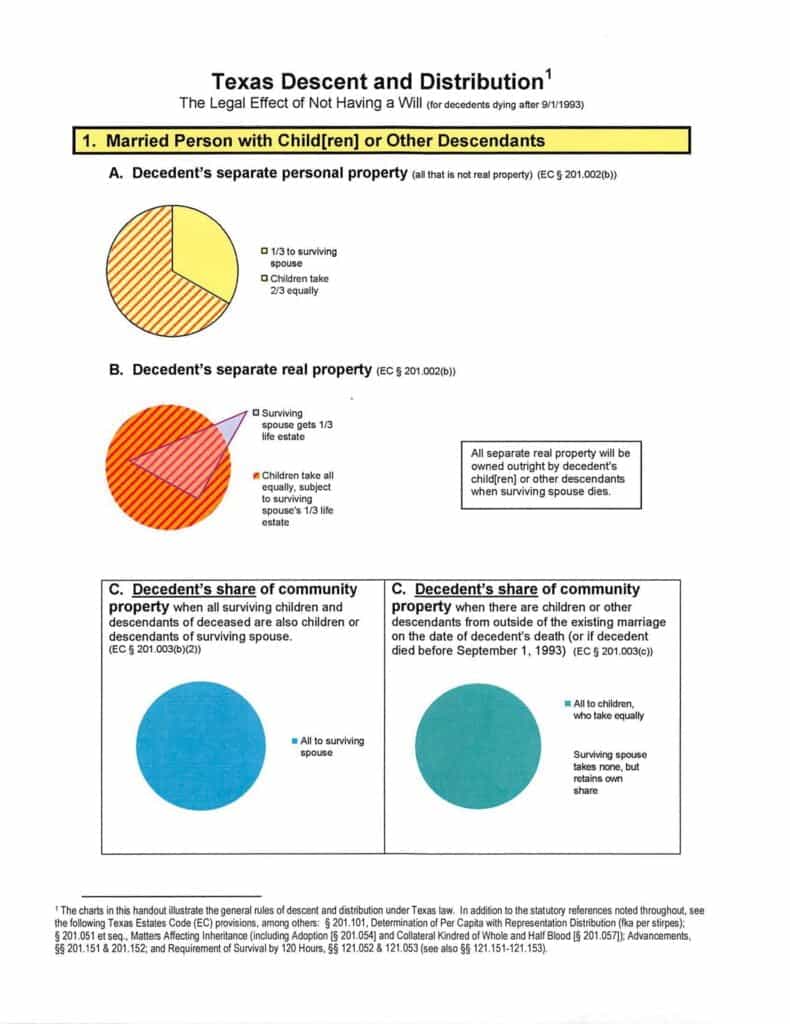

Married Individuals with Children

For married individuals with children, the division of property depends on whether the property is classified as separate or community property:

- Separate Personal Property: One-third goes to the surviving spouse, and the remaining two-thirds are equally divided among the decedent’s children.

- Separate Real Property: The surviving spouse receives a one-third life estate, while the children inherit the property equally, subject to the spouse’s life estate.

- Community Property: If all the decedent’s children are also the children of the surviving spouse, the spouse inherits all the community property. However, if the decedent had children from another relationship, the community property is divided equally among the children, with the surviving spouse retaining their half of the community share.

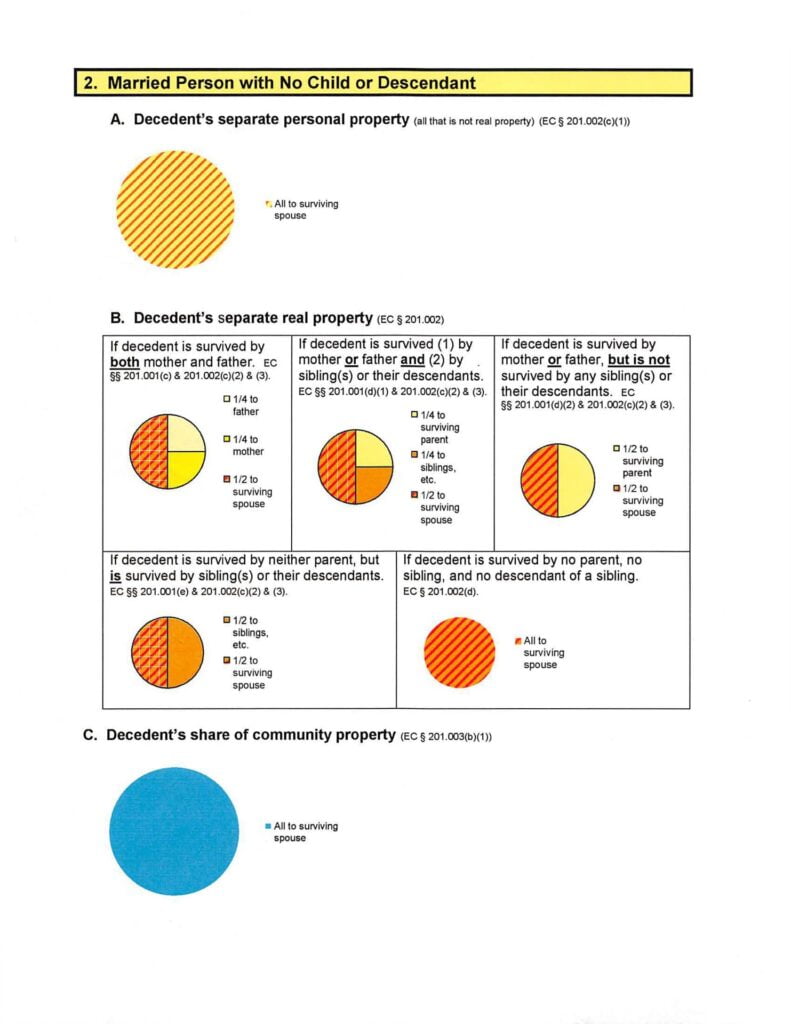

Married Individuals Without Children

If a married person dies without children, the surviving spouse generally inherits all of the decedent’s property, both separate and community. However, the distribution of separate real property can involve the decedent’s parents or siblings depending on their survival.

- Separate Personal Property: All goes to the surviving spouse.

- Separate Real Property: The surviving spouse receives half, with the remaining half divided between the decedent’s parents or siblings, depending on who is still alive.

- Community Property: The surviving spouse inherits all community property.

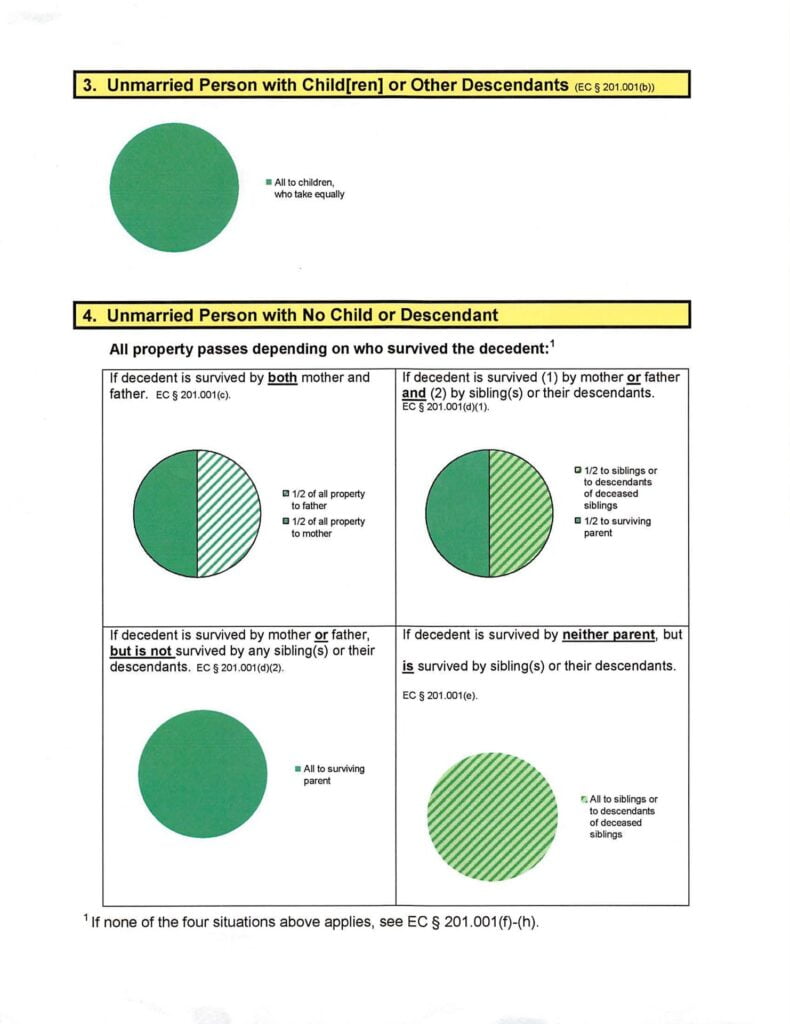

Unmarried Individuals with Children

For unmarried individuals who pass away without a will and leave behind children, the estate is divided equally among the children. Each child receives an equal share of both the separate personal and real property.

Unmarried Individuals Without Children

For unmarried individuals without children, the estate passes to the decedent’s parents, siblings, or other relatives, depending on who survives the decedent:

- Both parents are alive: The estate is split equally between them.

- Only one parent is alive: The surviving parent receives half, and the other half is divided among the decedent’s siblings or their descendants.

- No parents or siblings survive: The estate is distributed among more distant relatives.

Why You Shouldn’t Die Without a Will

The Texas laws of intestate succession are a safety net designed to provide a fair distribution of assets, but they may not align with your personal wishes. By dying without a will, you risk having your estate divided in ways that could lead to disputes or unintended consequences. Creating a will allows you to specify how you want your assets distributed, ensuring that your loved ones are taken care of according to your wishes. Even if the above diagrams match your wishes, probate without a will is a significantly longer and more expensive process than probate with a will. Trusts are designed to avoid probate altogether.

Conclusion

Understanding the implications when you die without a will in Texas is essential for making informed decisions about your estate. While intestate succession laws provide a default method for distributing assets, they may not reflect your personal wishes and lead to a long, expensive probate. To have control over your estate and ensure that your loved ones are provided for, it’s important to create a will that clearly outlines your intentions.

Disclaimer:

The information provided in this article may include legal or tax information, but it does not constitute legal or tax advice and should not be construed as such.

Comments are closed.